rhode island income tax withholding

In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of three. Like most other states in the Northeast Rhode Island has both a statewide income tax and sales tax.

Rhode Island Division Of Taxation 2019

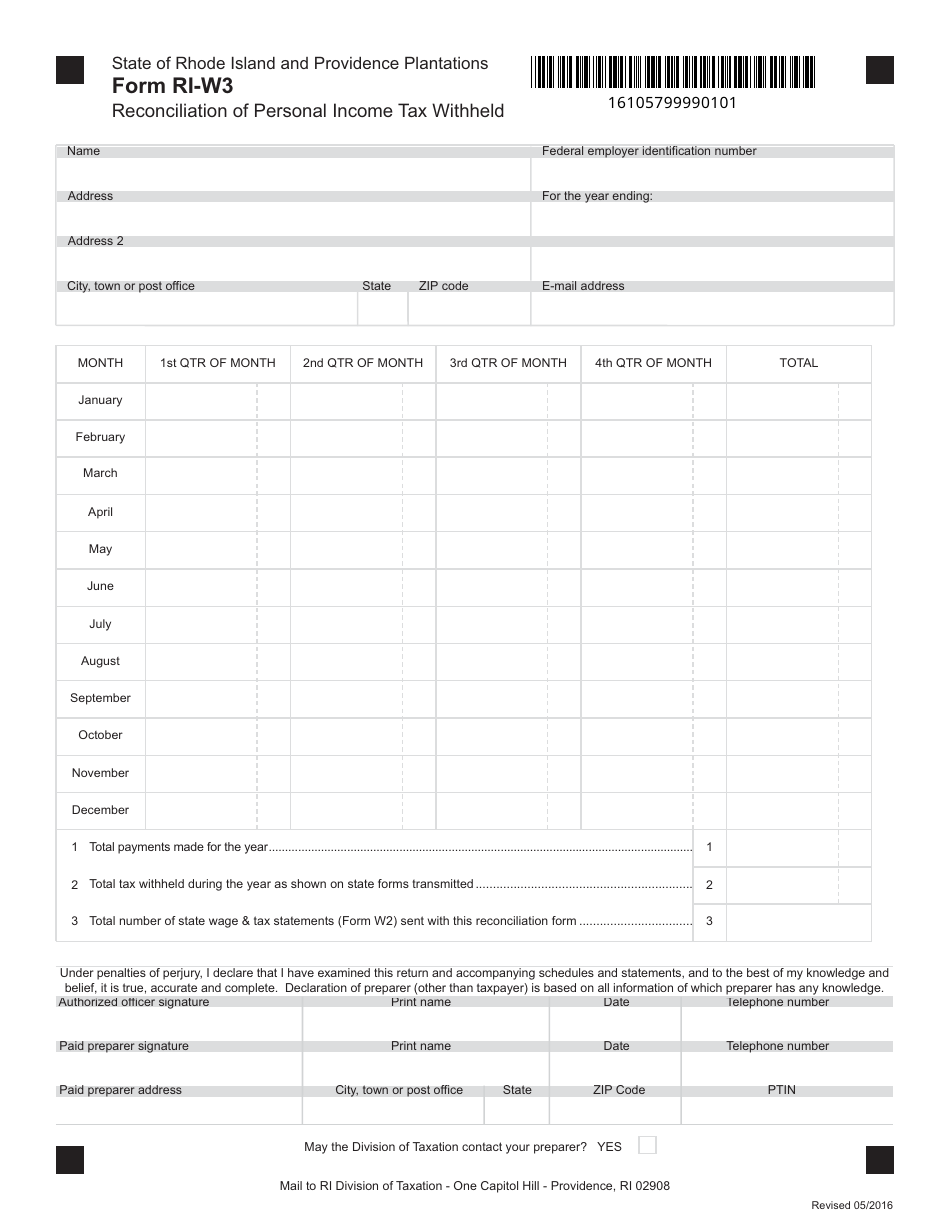

REPORTING RHODE ISLAND TAX WITHHELD.

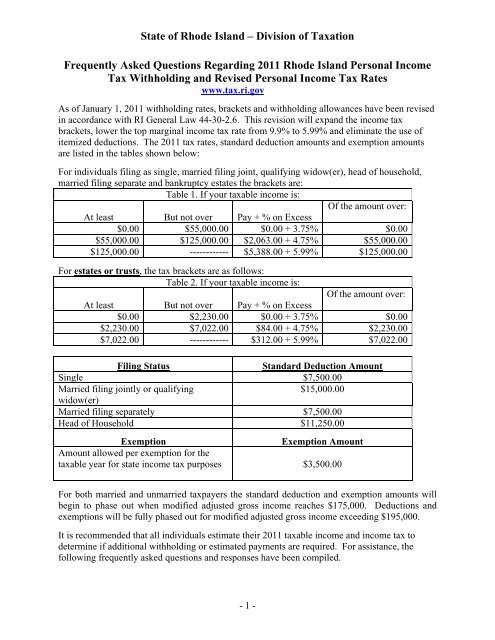

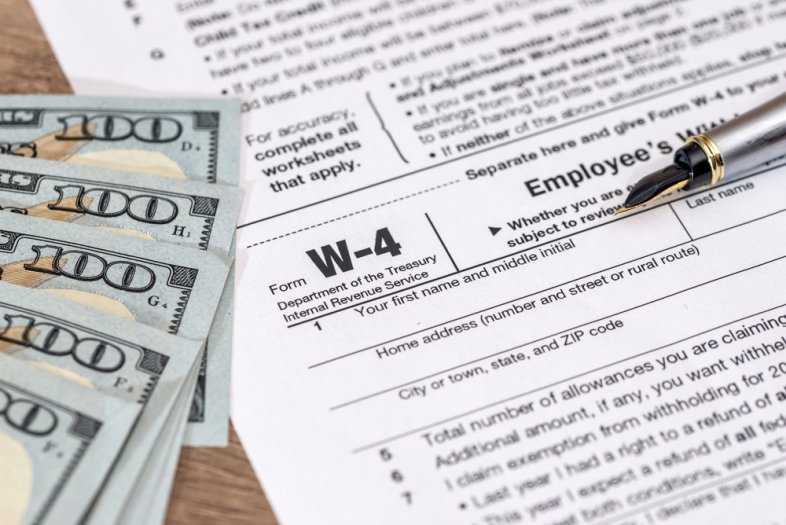

. Individuals filing joint Rhode Island income tax returns incur joint and several liability for the Rhode Island income tax. The income tax withholding for the State of Rhode Island includes the following changes. Ad Fill Sign Email RI RI W-4 More Fillable Forms Register and Subscribe Now.

Download or Email RI RI W-4 More Fillable Forms Register and Subscribe Now. The annualized wage threshold where the annual exemption amount is eliminated. Download or Email RI RI W-4 More Fillable Forms Register and Subscribe Now.

Ad Accurate withholding repotting to federal state and local agencies for all transactions. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. An employer may withhold Rhode Island personal income tax at the request of the employee even though the employees wages are not subject to Federal income tax.

Permit to make sales at retail. Rhode Island Income Tax Withholding Certificate RI-W4 RI W-4 2022pdf. An Official Rhode Island State Website.

Employers must report and remit to the Division of Taxation the Rhode Island income taxes they have withheld on the following basis. The income tax is progressive tax with rates ranging from 375 up to. If your state tax witholdings are greater then the amount of income tax you owe the state of Rhode Island you will receive an income tax refund check from the government to make up the.

Automate manual processes and eliminate human error with Sovos tax wihholding solutions. Rhode Island regulatory law provides that a Rhode Island employer must withhold Rhode Island income tax from the wages of an employee if. UMass employees who reside in Rhode Island use the RI-W4 form to instruct how RI state taxes should be.

BAR Business Application and Registration PDF file less than 1mb. The income tax withholding for the State of Rhode Island includes the following changes. An employer may withhold Rhode Islands personal income tax at the request of the employee even though the employees wages are not subject to Federal income tax withholding.

Personal Income Tax - Employers Withholding. Prior Year 941Q Quarterly Withholding Return - ONLY FOR USE FOR PERIODS ON OR BEFORE 12312019 PDF file. If you do not have a RI location print the form and mail it in with applicable fees Income tax withholding account including withholding for pensions or.

The annualized wage threshold where the annual exemption amount is eliminated. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. A the employees wages are.

Residents and nonresidents including resident and.

State Of Rhode Island Rhode Island Division Of Taxation Ri Gov

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

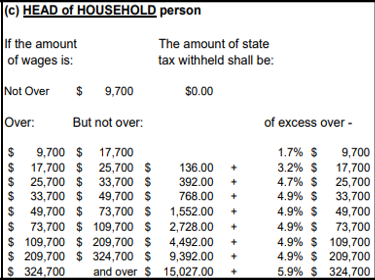

State W 4 Form Detailed Withholding Forms By State Chart

Pin By Home Care Assistance Of Rhode On Home Care Assistance Blog Checklist Template Planning Checklist Checklist

Tax Withholding For Pensions And Social Security Sensible Money

Payroll Taxes A Beginner S Guide For Employers

Pin By Home Care Assistance Of Rhode On Home Care Assistance Blog Checklist Template Planning Checklist Checklist

State W 4 Form Detailed Withholding Forms By State Chart

Form Ri W3 Download Fillable Pdf Or Fill Online Reconciliation Of Personal Income Tax Withheld Rhode Island Templateroller

Form W 4 Employees Withholding Allowance Certificate W 4 Pdf Fpdf Docx

How To Adjust Your Tax Withholding For A Larger Paycheck Mybanktracker

State Income Tax Withholding Considerations A Better Way To Blog Paymaster